|

|

|

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

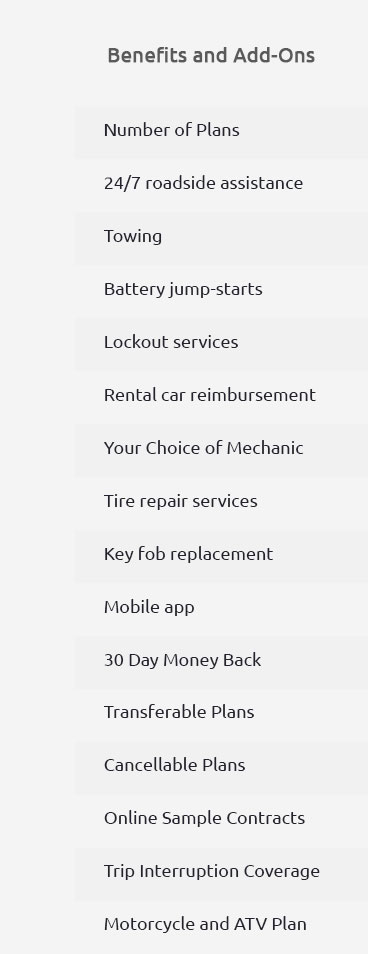

Cap Insurance Car: A Comprehensive Coverage GuideExploring car insurance can be a daunting task, especially for U.S. consumers who are new to vehicle protection and repair costs. This guide will walk you through the essentials of 'cap insurance car', focusing on the benefits of peace of mind, cost savings, and what's covered. Whether you're considering an extended auto warranty or just looking for more information, we've got you covered. Understanding Cap Insurance CarCap insurance car, also known as capped price servicing or fixed price servicing, is an automotive industry concept where the cost of vehicle services is set at a maximum amount. This ensures drivers aren't hit with unexpected high repair bills. Benefits of Cap InsuranceChoosing cap insurance comes with several advantages:

What Does It Cover?Generally, cap insurance covers a wide range of vehicle repairs and services. Here’s a typical list:

For specific makes, such as Mercedes, consumers might consider an extended warranty. Check out purchase mercedes extended warranty for tailored coverage options. Exploring Extended Auto WarrantiesExtended warranties offer protection beyond the standard manufacturer warranty, often including roadside assistance, rental car coverage, and more. It's a smart choice for those seeking additional peace of mind. Key ConsiderationsWhen evaluating extended warranties, consider the following:

For comprehensive options, visit vehicle one warranty coverage for details. Frequently Asked QuestionsWhat is cap insurance for cars?Cap insurance for cars sets a maximum price for servicing and repairs, providing predictable costs for vehicle maintenance. How does it benefit U.S. car owners?It offers peace of mind by capping repair costs, protecting against inflation, and ensuring your vehicle is serviced by trained professionals. Can I combine cap insurance with an extended warranty?Yes, combining both provides extensive coverage for both routine maintenance and unexpected repairs, maximizing your protection. For consumers across the U.S., including those in bustling cities like New York and Los Angeles, cap insurance car offers a reliable way to manage vehicle expenses without surprises. It's about smart planning and enjoying the journey, worry-free. https://www.american-transit.com/capcomauto.html

CAP Commercial Auto. The CAP, Commercial Auto, program offers insurance coverage for the vehicles of skilled tradespeople. https://www.capinsurancegroup.com/

Whether its home, auto, renters, boat or flood, we can help protect ... https://business.cap.co.uk/cap-insurance

CAP supports the Motor Insurance Sector, creating trusted and accurate valuations to support the claims management processes.

|